IF USERS DO NOT SATISFY, THEY WILL LEAVE YOUR APPLICATION FOR ANOTHER APPLICATION

Started as a startup with the product of an application on SIM, providing phone recharge service, in early September 2020, the MService company, the owner of the MoMo Wallet application, officially announced this e-wallet has reached the milestone of 20 million customers, growing 40 times in 5 years.

Accordingly, if at the beginning of 2015, the number of users of MoMo Wallet was 500,000 users, in 2019 reached the milestone of 10 million, and by 2020, this number would double, reaching 20 million in early September 2020.

Mr. Nguyen Ba Diep, Co-Founder, Vice Chairman of MoMo Wallet affirmed that, during the past 10 years, MoMo has not changed its goals, but it changed the way of making and the model to achieve the set goals.

Although each change has its own difficulties, Mr. Diep said that the decision to convert MoMo from a mobile SIM application (mobile money model) to a smartphone application in 2014 was the most difficult one, because this transformation required the destruction of the entire technology platform as well as business thinking. "It was a very risky decision at that time, but it helped us succeed when we were a long way ahead of all other units in the market", Mr. Diep said.

Recounting the 10-year journey, according to Mr. Diep: "In 2009, we started MoMo with Mobile Money. This is the mobile e-wallet model that was first deployed in the Philippines in 2003, the wallet is integrated onto the mobile SIM, and all transactions are done via SMS. MoMo collaborated with a mobile operator to launch mobile money in 2010. "We traveled all the way across Africa to Kenya, Tanzania, Uganda, as well as the Philippines to study the mobile money business very carefully. However, what we did not expect is that each country has huge differences in legal basis, banking infrastructure and consumer behavior, which will have a big impact on the success of the service. ", Mr. Diep recalled.

In addition, according to Mr.Diep, another key point that made the MoMo model unsuccessful at that time was technology limitations when the entire capacity of the mobile SIM was very small, only 64-128Kb. So the e-wallet application on the SIM has a very rudimentary interface, is difficult to use, cannot update the new version and is limited to a mobile network only. "Another special thing is customers do not put their trust in the service while regarding money, trust is very important", Mr. Diep said.

Then, in 2014, MoMo decided to switch to program a financial application on smartphones. This was a very reckless and dreamy decision at the time, when smartphones accounted for only about 20% of the market share in Vietnam and mobile applications were not popular; no one knew what would happen in the future. For this new technology, MoMo rebuilds everything from zero. In addition to adjusting in terms of technology, recruiting new staff, the company also has to adjust the mindset of all employees, from making a minimum viable product for a niche, to focusing on customer experience for the mass market, similar to FMCG.

By 2016, when the application was relatively stable, MoMo introduced the innovative development philosophy "MoMo does not need customers, MoMo needs happy customers". Explaining this philosophy, Mr. Diep said that in fact, having a client is not difficult, but keeping that client with the service for a long time is difficult. If customers are not happy when using MoMo's service, they will never come back. "This philosophy is fully applied by us to all customers and partners. Products are optimized in any small details to satisfy customers' needs, reducing operations that need to be used when checking out", Mr. Diep confirmed.

For example, when a customer uses a banking application to pay via the static QR Code model, it is necessary to perform 5 at with a total time of about 40 seconds. The user needs to login, then scan the merchant's QR code and enter the payment amount, confirm the payment, pay and give the result to the seller. Meanwhile, MoMo also applies dynamic QR Code. For this model, customers only need to take a single step to give their BarCode (barcode) code to the sales unit to scan. This has reduced 4 steps in the payment process for customers , and now it only takes about 2-3 seconds to make a payment.

In addition to enhancing the payment experience, MoMo also has interactive programs such as Đi bộ đổi Heo vàng (Walk for Golden Pig) or crowdfunding programs for charitable purposes that have attracted more than 5 million customers to participate. Fun and entertainment programs on the occasion of Lunar New Year 2020 - Lắc xì (Shake for lucky money) was also participated by 8 million customers.

About the biggest achievement in the 10 years of developing Momo, Mr. Diep said, "the biggest achievement is having a community of 20 million customers, hundreds of thousands of partners, and the desire to use technology to bring financial services to the people has been initially actualized". At the same time, creative innovation is making new and unprecedented things. Therefore, an open juridical corridor and support for innovation is essential for the development of technology businesses, especially in the financial sector.

"Every step is a valuable experience and lesson learned from the times of failure, which formed MoMo as it is today. I always think that if I do not try, how can I know if I am wrong, because in order to make products as well as scientific research, I must dare to try, dare to do, dare to be wrong to progress and to innovate, Mr. Diep shared.

DO WHAT NO ONE DID BEFORE, "DECONSTRUCTING AND RECONSTRUCTING" MANY TIMES IS … COMMON.

The co-founder of Momo said that the goal of this application is to use technology to change the lives of Vietnamese people and help people have equal access to financial services. This has never changed in the past 13 years. "I think that in order to do a big thing, which no one has been able to do in Vietnam, it is very normal to do it over and over again," said Vice Chairman of Momo.

For those who have a startup spirit, who have a belief that is large enough to work for their expected goal, each unsuccessful project will be a lesson, a stone paving the way to reach the ultimate goal. In this world, there is no succeeding-from-the-first-time story, we have to struggle with the goal, live and die with it to be able to accomplish it.

According to Diep, it is fortunate that MoMo has gathered a well-trained team from abroad (Chicago, Harvard, Yale, Columbia) that has international experience and shares the same target with the company founders in using technology to change Vietnamese lives. All of our brothers have the same viewpoint to try to do something great, to show everyone that Vietnamese wisdom is not a vanity.

"MoMo is also the only electronic wallet in the market to receive capital from US investors like Warburg Pincus and Goldman Sachs. Big investors have a global vision, long-term investment, understand trends and encourage us to use our investment capital to build a Vietnamese intellectual product and do things no one dares to do ", Mr. Diep shared about an advantage of Momo.

USING PROMOTIONS TO ATTRACT USERS MEANS WE HAVE NOT UNDERSTOOD WHAT THEY WANT

When asked if MoMo is concerned that other e-wallets could focus on promotions to attract their users, Mr. Diep said that using promotions to attract customers is the traditional way of doing business, but it is only effective when the market is new and customers do not fully understand the product. For MoMo, we have not used promotions to attract customers since the beginning of 2019, but have focused on enhancing the service experience, providing customers with all necessary services in life. If customers feel happier when using MoMo's service, they will stick for a long time.

One of the advantages over other foreign units in the market is that MoMo develops its own products for the Vietnamese market, focusing on the most essential services for users: dining, travelling, entertaining, shopping, utilities (electricity, water, telecommunications) or finance, insurance, public services, etc. Other applications, due to service provision in many countries, will develop a common product for the whole region. They are unable to make a single product for a specific country that serves the experience for only one country.

The market has quite a lot of potential, MoMo has only 20 million customers for a market of 100 million people, so it is necessary for all service providers to promote programs to encourage customers to use cashless payment. "Customers are very smart, they will decide which service to use that best suits their needs. If anyone believes that they can use promotions to attract customers, they do not really understand what users want ", Mr. Diep expressed.

With the view that the current fintech market is a battle to burn money to attract users when most of the e-wallet businesses suffer losses, Mr. Diep has strongly recognized that no one is foolish to "bring money to burn" because investment in innovation takes time as well as a large investment to achieve scale.

Technology businesses all have to invest for a very long time and accept large costs in the beginning. In the world, this is very normal. For example, Tesla is the largest electric car company in the world, worth $295 billion, but has so far been unprofitable since its inception in 2003. Airb2b, Snapchat, Dropbox… are similar.

COVID-19 AND MOBILE MONEY WILL "RAISE DEMAND" FOR THE NON-CASH PAYMENT

Mr. Diep emphasized that, in addition to the negative factors, the Covid-19 pandemic has had a positive influence on non-cash payments and digital conversion of businesses, households and individuals.

With the traditional business model in the past, businesses and individuals both feel relatively well. Therefore, payment via e-wallet or digital conversion is not necessary. When the epidemic happened, the whole traditional business model collapsed. With people staying at home instead of going to the store, everyone realized that selling online and online payment is the salvation for businesses.

Mr.Diepcitedtwostoriesaboutthischange,aboutwhenhetalkedwiththedirectorofachainofoneofthelargestcoffeeshopsinVietnam.Inthepast,whenheproposeddigitaltransformationtoleaders,itwasverydifficult.Everyonelistenedandunderstoodbutdidnotdoitbecauseofcertainbusinesspressures.Moreover,becauseitisabigchain,eveniftheydidnotgoonline(toanonlineenvironment-PV),customerswerestilltheonessobbing.ButtherecentCOVID-19pandemichascausedasharpdeclineinrevenue,whileemployees'salariesandoperatingexpensesstillhavetobepaidforbyallmeans.Inashorttime,ithastodeployanonlinechanneltooffsetsales.

Another example, MoMo Wallet currently provides collection services for insurance and financial companies. During this time, the number of transactions via MoMo also increased sharply because people, instead of going to the stores to pay or pay insurance, all did so online.

"The story of changing perception about digital transformation is prevalent in almost all of the partners that MoMo Wallet has met in the past half year. The mindset "go-online" of Vietnamese business leaders has changed positively. When the quantity changes, the quality will change, I believe within the next 12 months, the electronic payment industry will have great developments and MoMo Wallet will have a positive impact on the overall growth of the industry ", Mr. Diep confirmed.

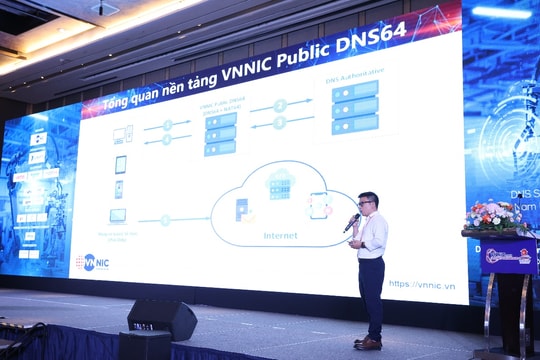

Sharing about the Mobile Money pilot project, Mr. Diep believes that this service will have many positive effects, promoting non-cash payments in Vietnam in remote areas where people do not fully have access to financial and banking services. In remote areas where banking services have not yet reached, Mobile Money is a simple e-wallet, which does not require users to have a bank account. Besides the Mobile Money model, recently, the State Bank of Vietnam has allowed many commercial banks to experiment with online account opening models, applying eKYC with very encouraging results. This is also a way to help people easily open accounts for many purposes, including e-wallets. "In the near future, if the regulations on correspondent banking models are promulgated, customers can use banking services anytime anywhere at authorized agents. Thus, electronic payment will develop very smoothly ", Mr. Diep said.

Before the question was whether MoMo was concerned that the Mobile Money service would use "the countryside to surround the city" and turn around to attract users of this e-wallet in big cities, Diep said. The new electronic payment is at the first stage of strong development in big cities. For electronic payment to develop, the units must come together to develop. MoMo Wallet is developing in the direction from urban to rural, while mobile money is growing from rural to city, it is good for the market, and good for customers, because no one is left empty.

Customers will be the one to decide which service is most appropriate, not service providers. At the same time, we believe that this is a golden time to popularize and promote cashless payments to Vietnamese people as the market is still large enough for many units to exploit together. This aligns with the Government's comprehensive financial promotion policy.